“The Car Speaks to the Insurance Company”

Zurich is one of the world’s largest insurance groups and has ambitious goals: even more customer focus, growing margins, and a 20 percent return on equity. But how can this be done? The Swiss insurer’s German subsidiary presents a practical example.

03/2023

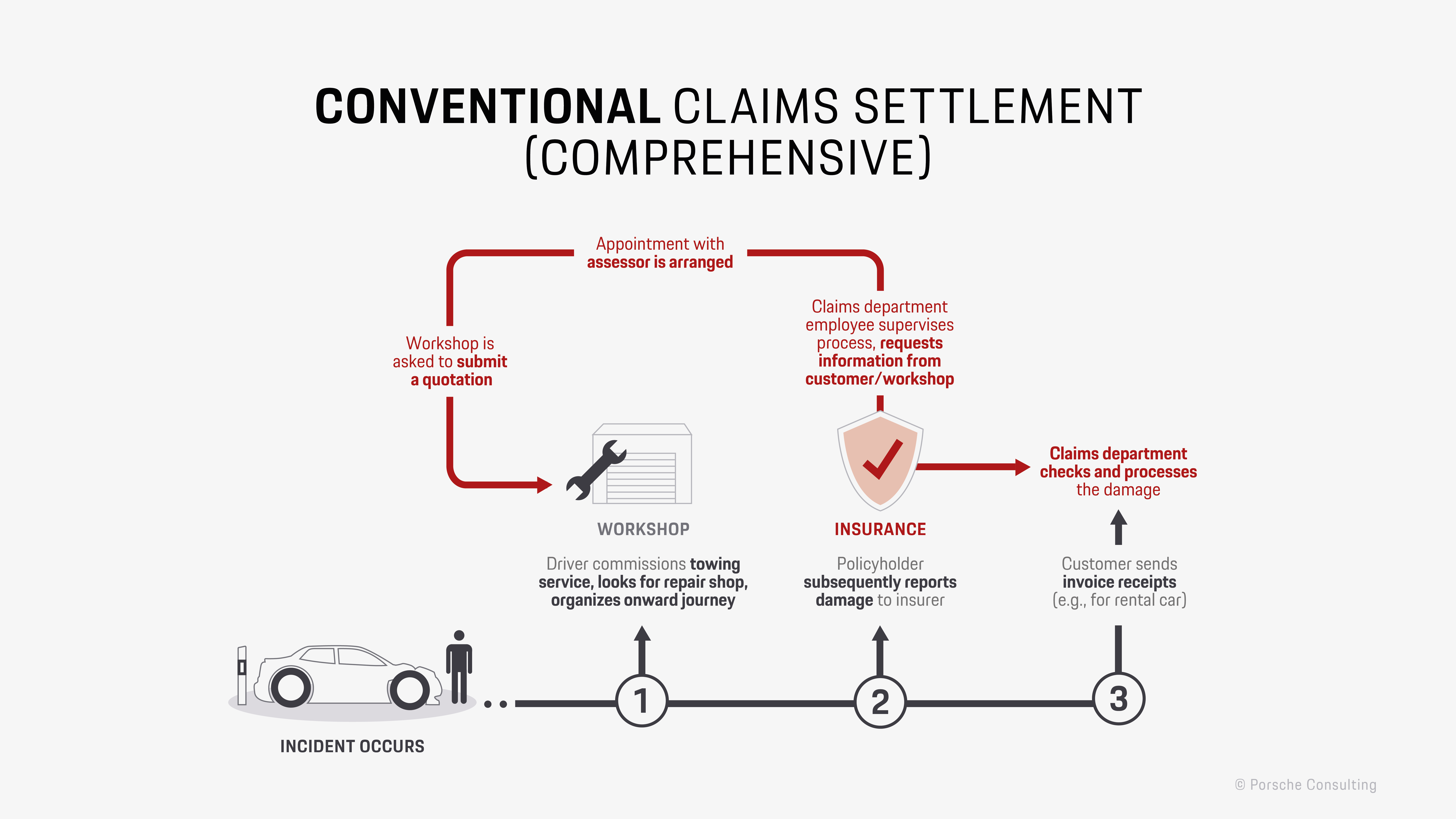

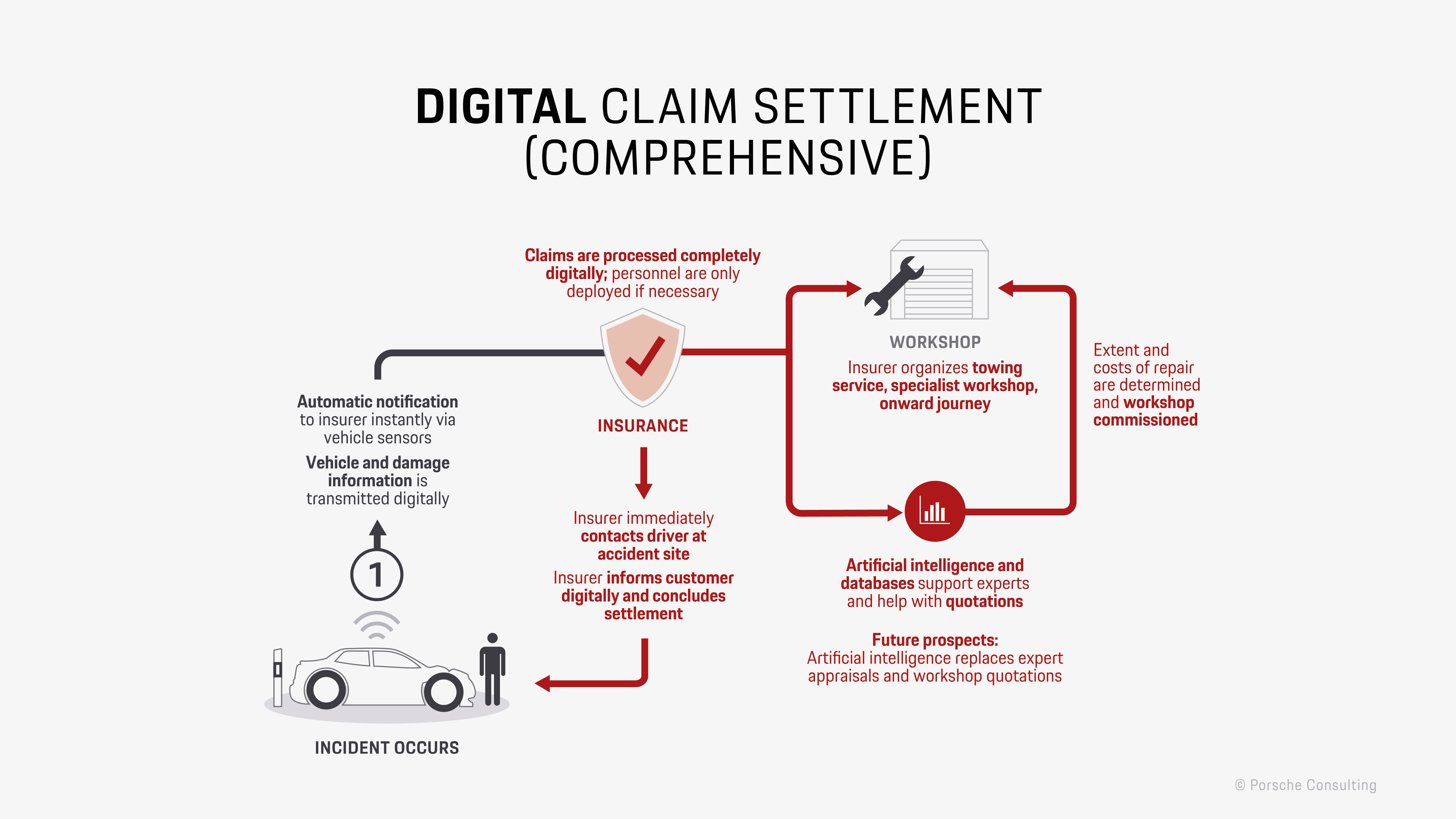

Comprehensive car insurance pays out in the event of damage, destruction, or loss of the vehicle. When customers report a claim, a time-consuming and personnel-intensive process begins for their insurance company. In addition to general claims processing, it often involves legal expertise and expert opinions. This takes time, is expensive, and squeezes profit margins in comprehensive insurance. Horst Nussbaumer intends to change that—by using artificial intelligence and data analysis in claims processing. And it starts right from the very first second. “Now the car speaks directly to the insurance company,” says the chief operating officer and head of claims, IT & operations at Zurich Group Germany. Nussbaumer’s concept reverses the traditional process, because in the event of a claim, the customer no longer has to contact the insurance company. Instead, at the moment the damage occurs, the car automatically reports it to the company and feeds the computers with data from the event. The insurer then instantly contacts the driver to provide assistance, for example with a towing service, a nearby workshop, and a replacement car. It may sound like science fiction, but initial trials are already underway.

The test fleet is on the road

Nussbaumer has recently been trialing a small fleet in ordinary road traffic. He says, “Modern cars already send a wealth of data, but there aren’t enough users who can do something with it.” The technical prerequisites are already pretty much there thanks to built-in sensors and electronic network integration in the vehicles. The “Zurich Call” builds on this. The aim is for the vehicle to automatically register an accident and report all the relevant data directly to the insurance company. The sensors in the car, mobile telephony, and satellite navigation provide the technical basis. Airbag deployment is one of the signals that would cause the accident to be reported to the insurance company, but drivers can also trigger the notification manually by pressing a button—for example, in the event of minor damage.

A highly motivated, interdisciplinary team is working on practical implementation at Zurich. “When cars started talking to each other, we saw new opportunities,” recalls Horst Nussbaumer, who has been pushing the idea forward for around five years now. The first task was to take the flood of data that vehicles provide and identify the information that is relevant for car insurance. But that was not enough, because patterns had to be recognized: which components in each type of vehicle are most likely to be damaged in typical rear-end collisions? How much damage occurs on average when a car hits a concrete bollard while parking?

Zurich in figures

Expertise from the market

Now it was a matter of analyzing the data. Ordinarily, Zurich would have had to accumulate new expertise to do this. “But why build it up ourselves when the knowledge and skills already exist elsewhere in the market?” says Nussbaumer, who specifically focuses on core competencies as an insurer. And so he brought a team from management consultancy Porsche Consulting on board. Since the beginning of 2021, the Porsche experts have been working as guides to this terrain, which was previously quite unknown to insurance companies. Just one year later, the insurance company’s in-house project team at the Zurich Campus in Cologne now has all the skills and knowledge—as well as the assistance of artificial intelligence—to correctly interpret and process the relevant data for handling and settling claims and convert it into tangible services for the customer.

Even so, Zurich still regards technological tools as a way to improve services, rather than as a substitute for personal attention: “Our top priority is to be close to people, to our policyholders,” says Nussbaumer. “That’s why we will never let machines work alone when it comes to dialogue with our customers in the event of a claim.”

Customers must be able to trust their insurers to handle their data with care. The digital information on accident damage that the vehicle sensors supply belongs neither to the insurance company nor to the car manufacturer. It belongs solely to the person behind the wheel. This means the driver must consent to its use. If they have done so, they can be offered immediate assistance in the event of an accident. This means the insurance company is right by their side. “This is important to us,” emphasizes Horst Nussbaumer.

Faster, simpler, fully digital

How Zurich will provide immediate help in the event of accidents

A strong network of partners

The insurance company also finds out the nature and extent of the damage much earlier than before thanks to the data that is transmitted directly and automatically. This includes information that allows an initial estimate of repair costs. “This means we can process claims more efficiently and also at a much lower cost,” says Nussbaumer. Speed often saves money, and this not only benefits the insurance company. Customers also benefit, and so do all the partners in the network, such as car manufacturers with their authorized workshops as well as companies providing tow trucks or replacement rental cars.

“Providing the best possible customer experience in the digital processing of comprehensive insurance claims is a joint task for partners acting in harmony with our values and expectations. If this succeeds, everyone involved profits,” says Nussbaumer. He says that an “orchestra of vehicles and associated services” is coming together. Zurich has set itself the goal of becoming the leader in the claims sector. “But we don’t want to always be the conductor,” says Nussbaumer. “Insurers generally can’t put themselves at the center of ecosystems.”

Complex innovations also require patience and perseverance. Developing a perfectly functioning digital system for claims processing is, he says, a long, frequently changing process: “a journey, not a sprint.” Nussbaumer then continues, “To achieve this, we and the other partners involved must learn, and must take things step by step.” The goal, he says, is to obtain excellent data, to achieve rapid processing and settlement, and to stay close to the customer throughout the process, from the accident to the conclusion of the claim. “The result of all that is what makes the difference in quality,” Nussbaumer stresses.

Added value in a package

The product of motor vehicle insurance itself is largely interchangeable, he says. Now the job is to find the target groups that are open to the new, digitalized process. And the emphasis is on groups, because addressing every car insurance customer individually would “not be very effective.” This is why Zurich is focusing on offers as part of a wide range of value-added services provided by the dealer when a new car is purchased or leased. Three years of service included? Mobility guarantee? Digital claims settlement as well? To make sure the offers are linked at the beginning of the contractual relationships, Zurich wants to closely involve the automobile manufacturers in its concept. Once that is done, the next step, according to the COO, is to bring all the other insurers to the table: “If we work together as an industry, we will quickly achieve the necessary standardization in digital comprehensive claims settlement.” Nussbaumer makes this appeal: “The automotive and insurance industries should step on the gas together now.”

The customer perspective is the key to success

Two questions for Dr. Henning Droege:

1. What role did Porsche Consulting play in the transformation process of Zurich Group Germany?

With our mobility and digitalization expertise, we were able to help develop a cross-sector solution that creates real added value for the customers of Zurich Group Germany and all the other stakeholders. In developing and realizing this innovative business idea, it is important to bring together the right partners and connect them and their specific competencies in an effective way.

2. And how can the innovative business idea be successfully transferred into practice?

We took the perspective of a customer who is placed in a stressful, unfamiliar situation immediately after an accident. What direct added value can they expect in the future from their insurance company and its network of partners through intelligent use of data in the event of a claim? Based on this premise, intensive work was then carried out on the identification, flow and, above all, interpretation of the data from the vehicles. The average new car is already equipped with numerous sensors that can provide data for qualified claims reporting. We analyzed these electronic sources, used them within the project for a pilot crash test with a typical vehicle, and were able to analyze valuable results. In parallel, more and more Zurich policyholders with their individual requirements will be involved in further development. Proximity to practice is crucial—the system must be convincing.